who we are

About the Edi

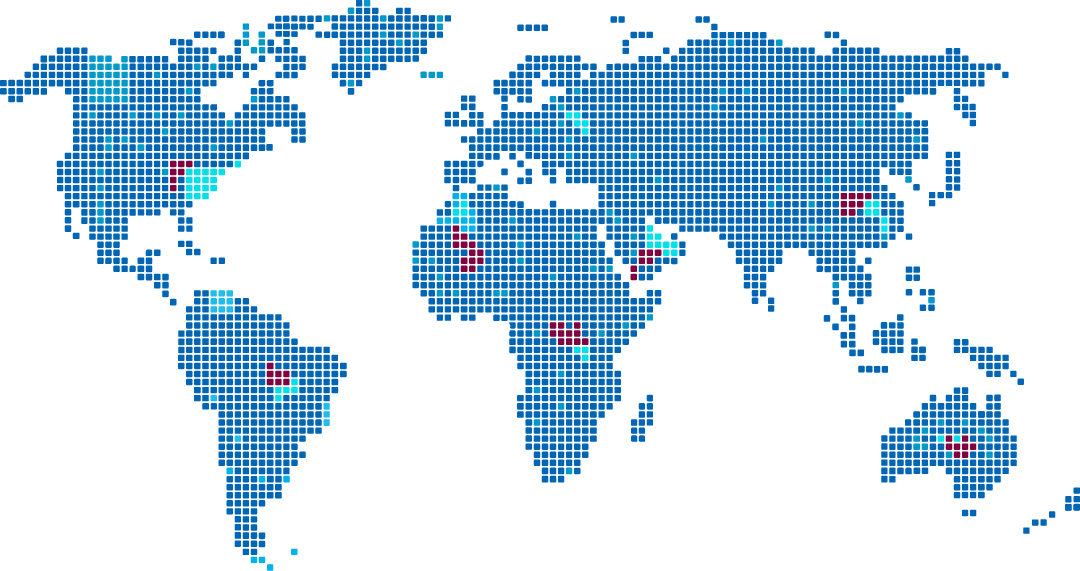

The Mohammed Bin Rashid School of Government (MBRSG) is launching the Global Economic Diversification Index (EDI) to assess the level of economic diversification in countries around the world and rank them based on their status and progress. The Global EDI aims to understand the nature of economic diversification and the factors that directly or indirectly impact a country’s overall level of diversification. The Index prioritises objectivity and accuracy and, as such, is based solely on quantitative measures. It aims to provides a quantitative benchmark and rank countries’ economic diversification efforts.

Highlights trends

How did economic diversification evolve over the past 22 years?

Explore EDI Trends

To analyze and measure the development and evolution of economic diversification, the empirical analysis starts from the year 2000, the earliest date with a consistent set of data for all the indicators included in the EDI. This allows a historical time series analysis of the evolution and extent of economic diversification across countries. Explore trends emerging from the cross-country, time series empirical analysis.

+

Explore EDI Trends

To analyze and measure the development and evolution of economic diversification, the empirical analysis starts from the year 2000, the earliest date with a consistent set of data for all the indicators included in the EDI. This allows a historical time series analysis of the evolution and extent of economic diversification across countries. Explore trends emerging from the cross-country, time series empirical analysis.

+